Thur 11 October 2018

By Heng Wang

Investment rules are of great significance to China as a leading importer and exporter of capital globally. Chinese investment under its Belt and Road Initiative and recent geopolitical dynamics increasingly require China to provide predictable rules that protect investors.

The recent evolution of China’s investment rules is best tracked in its free trade agreements (FTAs). China has concluded 16 FTAs with 24 countries and regions, nearly all of which include investment provisions. Malleability is the most striking feature of China’s investment rules in FTAs. The flexibility with which China approaches its investment agreements will affect the negotiated terms of mega-trade agreements like the Regional Comprehensive Economic Partnership, bilateral FTAs such as the proposed China-Sri Lanka FTA, and bilateral investment treaties (BITs), particularly the European Union-China BIT.

Two questions deserve attention: What is the trend of China’s FTA approach to investment? And is China a rule follower, shaker or maker?

Extending Malleability: from Investment Protection to Liberalisation?

Traditionally, China’s trade pacts focus on the protection of foreign investments, without liberalising the flow of such investments. This contrasts with the trade pacts of Western states, which both protect foreign investments of partner countries and liberally permit them. However, China is progressively moving towards investment liberalisation with selected partners – irrespective of the current uncertainty around the potential BIT between the United States and China. It is likely to continue to more frequently provide for ‘pre-establishment national treatment’ (i.e. allow foreign investors to enjoy terms at least as favourable as applying to domestic investors), and for the more liberal ‘negative list’ approach to investments (a system in which foreigner can invest in all fields that are not on the prohibited list without governmental approval, rather than a system of generally requiring approval).

There are several reasons for this progressive approach. Most importantly, investment liberalisation benefits Chinese companies investing overseas (by way of reciprocity). Chinese businesses have repeatedly asked the government to incorporate pre-establishment national treatment into investment treaties. Second, investment liberalisation helps to attract foreign investment to China and boost investor confidence, which is crucial for economic development and increasingly important in the current US-China trade war. Third, investment liberalisation may facilitate domestic reform in China through the force of international obligations, which has been the case since China’s accession to the World Trade Organisation. Last, there are no difficulties in implementing pre-establishment national treatment and a negative list approach in China. The US demanded these aspects during its BIT negotiations with China, and China saw the demands as a useful way to promote reform.

Increased Malleability on Regulatory Autonomy and Dispute Settlement

The increased malleability of China’s investment rules is apparent in two areas. The first is in theinvestor-state dispute settlement (ISDS), in which investors may bring claims against host state governments under the FTAs. The second is in regulatory autonomy, which affects the rights of host governments to regulate in the public interest, such as for public health.

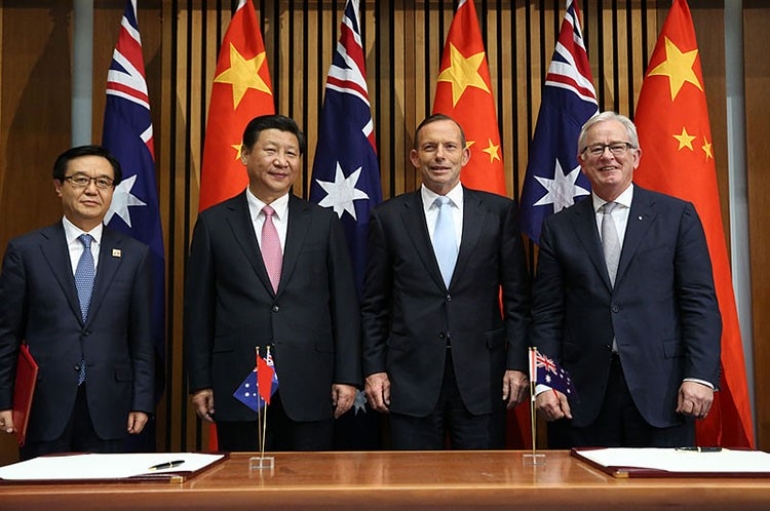

China’s trade pacts with Australia and South Korea differ significantly in these two areas. The China-Australia FTA (ChAFTA) is much stronger than other Chinese FTAs in preserving regulatory autonomy. In relation to the design of ISDS, the ChAFTA ensures that parties to the treaty have more control over ISDS; and in particular, in determining the scope of claims, selecting and regulating arbitrators, and providing interpretation and guidance. Most of these provisions are absent or less developed in theChina-Korea FTA.

This greater malleability is attributable to various factors. First, China is still exploring models for ISDS and regulatory autonomy in its FTAs. Second, China often relies on the proposals of FTA partners in FTA negotiations. It seems that the ISDS clauses in the ChAFTA, for example, reflect rising Australian caution with ISDS. Moreover, China has so far faced only a limited number of ISDS disputes, perhaps because investors and host state governments wish to avoid their potentially corrosive effect on bilateral relations.

China as a Rule Follower, Shaker or Maker?

China has not been a dominant norm-maker on key investment clauses, and will probably instead remain a rule-shaker in the short-to-medium term. Its FTAs largely build on the proposals of partner countries, as is evident in China’s FTAs with Australia and Korea. The China-Korea FTA and the ChAFTA appear to be affected, at least to some extent, by the US-Korea Free Trade Agreement and Australian approaches. This is probably why some key rules in the ChAFTA differ substantially from those in the China-Korea FTA. China’s role as a rule-shaker helps explain why it has not formulated a consistent set of FTA investment clauses. The Chinese paradigm incrementally converges towards deep FTAs—for example, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the EU-Canada Comprehensive Economic and Trade Agreement (CETA)—but detailed norms on investment protection are generally shaped by those who sit across the table.

On the other hand, China is not simply a rule-follower. It has a cautious attitude toward investment liberalisation and what it considers ‘intrusive’ requirements, and it has modified investment clauses when needed. These intrusive requirements pertain to, inter alia, Chinese state-owned enterprises (SOEs), labour, and the environment. China prefers to liberalise investment progressively to avoid unintended consequences.

In addition, China has demanded specific investment arrangements in its FTAs. Under the ChAFTA, it secured a more favourable environment for Chinese investment, including an easier threshold for non-SOE investment in Australia to be screened for approval, and related labour mobility provisions for Chinese workers. The screening threshold for non-SOE investment in Australia quadrupled from 0.248 billion AUD to 1.078 billion AUD. Moreover, to facilitate the mobility of Chinese workers for such investments, a memorandum of understanding on an investment facilitation arrangement (IFA) is included under the ChAFTA. It is the first of its kind granted by a developed country to China and may facilitate the processing of Australian visas under the arrangement.

In the long run, China has the potential to turn itself into a major norm-maker in investment treaties, since investment norms are the fastest developing area of its FTAs. However, continuing issues pose challenges for China. Further, China will probably need the strong support of major economies if it wants to shape new investment norms.